Boney: your solo and shared finances, finally clear and you'll quickly see why

We always had to cobble things together (and we were tired of it)

The beginnings: two budgets, zero clarity

It all started as it often does: moving in together, shared groceries, split subscriptions, restaurants, projects... and very quickly, the eternal question: "How do we keep track of all this?"

At first, we pulled out the good old spreadsheet. The one you update on the fly, between two texts, and forget as soon as the weekend arrives. We also tried simple apps, but they were too limited, not letting us see the whole picture. The result? A constant sense of vagueness. Each person thought they were managing, but no one really had a clear view.

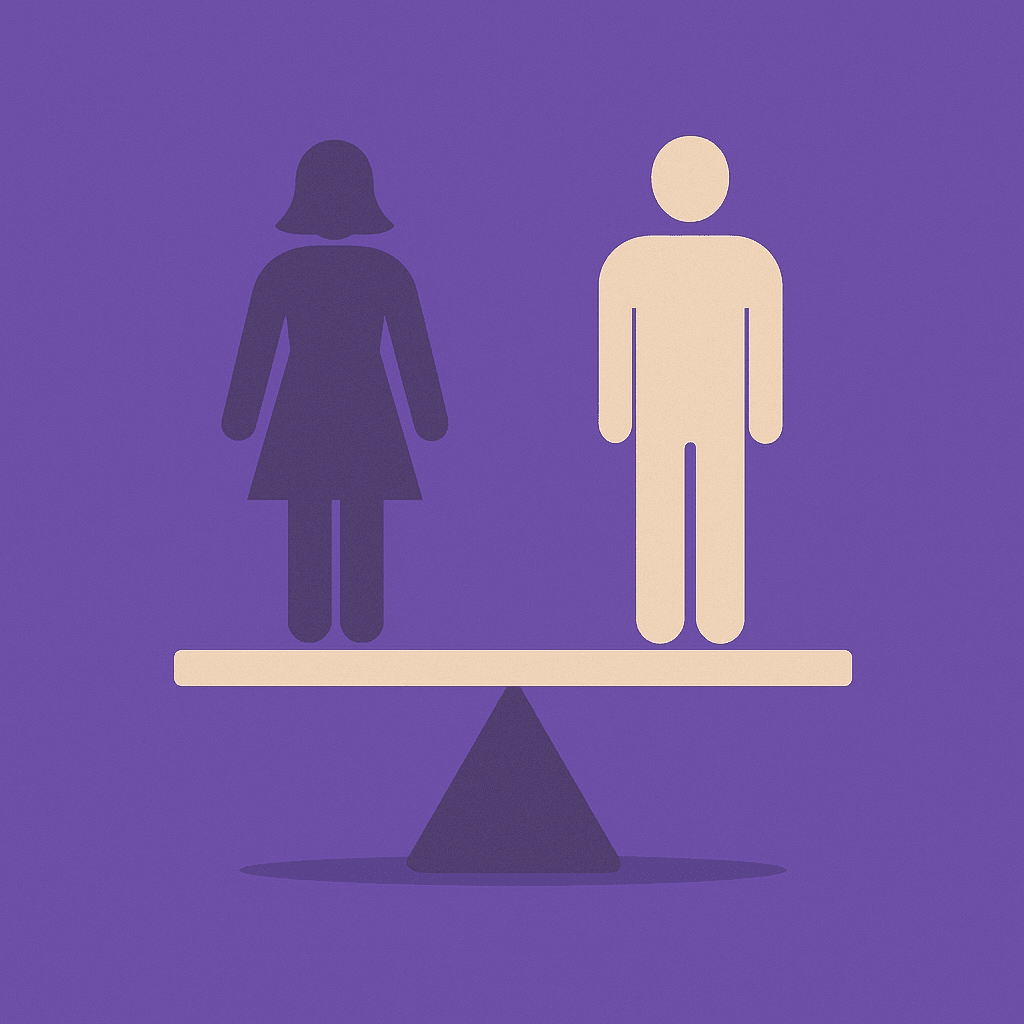

But deep down, it wasn't just about adding things up. It was about balance.

Because managing money as a couple (or as a group) doesn't mean mixing everything together. It doesn't mean monitoring the other person. And above all, it should never mean losing sight of your own financial freedom.

And that's a tension we often live with, without daring to name it.

You want things to be clear, but without having to justify every expense. You want to know where you stand, without being accountable. You want to treat yourself, plan, decide... while sharing part of daily life.

But the tools we had until now didn't allow for that.

A spreadsheet gives you visibility, yes, but not privacy. A quick reimbursement app settles the bill, but not the bigger question: what do we really share? And what do we keep for ourselves?

So, like many, we cobbled things together.

We added up, recalculated, sent messages like "can you pay me back the €17.35 from last week?". We let some expenses slide that we never really shared. We told ourselves "I'll keep track in my head" or "oh well, we'll see at the end of the month". And sometimes, we felt a bit alone facing our own bank account.

It wasn't dramatic. But it wasn't smooth either.

We didn't want to become management experts. We just wanted a simple, reliable tool that respected our autonomy while making things easier together. Something that didn't make you feel guilty. That didn't scare you off. And that would last over time.

Boney was born from a need we all have (but never name)

Seeing clearly together, without mixing everything up

The idea for Boney didn't come out of nowhere. It came from something very concrete, very everyday: that moment when you want to know where you stand... but first you have to sort out what you paid, what you owe, what you're owed, what you share, what you handle alone.

A real mental knot.

And yet, we're talking about money. Something we use every day. Something that directly impacts our choices, our desires, our tensions.

But we didn't have the right tools. Or rather, we had tools designed to manage... but not to understand. Technical solutions, rarely human. They tell you how much, but never what, why, how.

So we wanted to create a space where everyone keeps their own zone. Where we don't mix everything. Where financial independence remains intact, even in a shared project.

At Boney, we set a simple rule: what's yours stays yours. What's shared, we decide together, and it's clear for everyone. No interpretation, no headaches.

It sounds basic, but it changes everything.

Because suddenly, you can have your personal view and a collective view. You can move forward with confidence, without vagueness or unspoken issues. You can plan a weekend, a life together, a house share, or even family projects... without feeling trapped in a system.

And above all, you can stay free, while staying connected.

Stay in control, without the hassle

No one wants to spend their evenings doing the accounts. Even less chasing someone for 12 euros or digging through statements to understand where all the money went.

But we all want to know. We want to be able to say "I'm good" or "I need to slow down" without spending hours, without drowning in spreadsheets or feeling overwhelmed at the first unexpected expense.

That's where Boney changes the game.

Because you can set concrete goals, by category. You can see if you're sticking to your restaurant budget, if your Spotify subscription is accounted for, if your month is busier than expected. And all that, without needing a finance degree.

It's smooth, visual, and above all, it lives with you.

Doing shared groceries with your housemate? Boom, it's split. Want to track your personal expenses at the same time? No problem, it's built in. Want to plan your summer without stress? Boney shows you if you're on track or not.

You stay in control of your finances, without having to think about it all the time. And maybe that's what we missed most: a tool that doesn't add mental load, but helps you free yourself from it.

Boney doesn't tell you what to do. It sheds light on what you're already doing, so you can decide more calmly.

An app designed for real financial life

Solo, as a couple, in a house share, or as a group: everyone finds their place

What surprised us with Boney is how much the uses have diversified.

At first, we designed it for couples because that was our situation, because that's where the need hit us. But very quickly, housemates used it for monthly groceries. Groups of friends to organize a trip. Families to plan household expenses. Even freelancers to track their business expenses alongside their personal accounts.

And maybe that's Boney's real strength: it doesn't force you to live your finances a certain way. It adapts to yours.

Living alone? You can set your budgets, follow your pace, anticipate what's coming.

Living as a couple, but separate accounts? You can have your personal budget, a shared budget, and switch between them without getting lost.

Part of a group, a family, a collective project? You create a shared budget, everyone adds their expenses, everyone sees clearly and it's smooth.

No need to explain your life to the app. It lets you do things your way, but gives you what was missing: the big picture.

And that, whether you're a student, single parent, in an open relationship, or a career changer, is precious. Because we don't all have the same financial life. But we all need clarity.

Clarity, projection, sharing: the 3 pillars of Boney

We didn't try to reinvent everything. Just to do better where others stop.

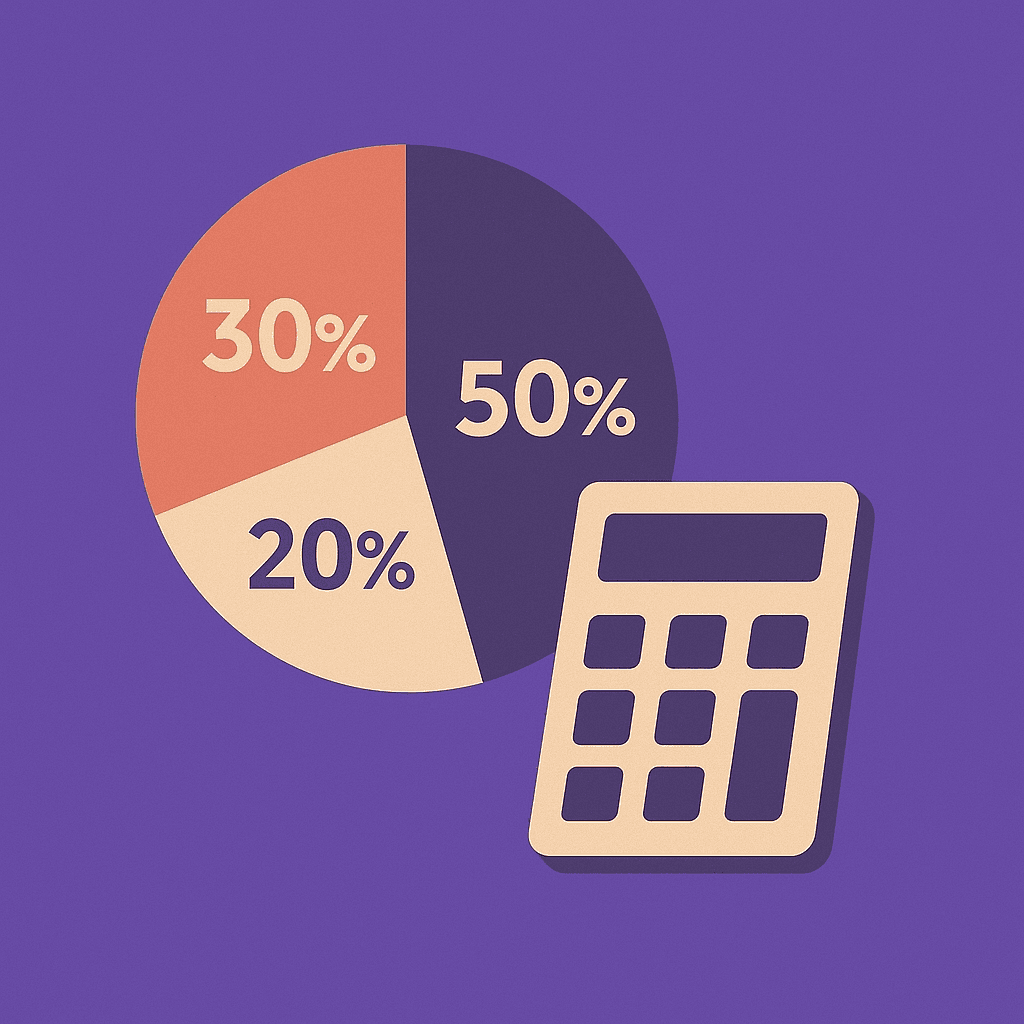

Clarity, first. Because if you have to spend 10 minutes understanding your budget, you won't do it. Boney helps you categorize your expenses simply, without imposing automatic choices that miss the mark. You know what each purchase means the app just gives you a clear framework to see things clearly. And once organized, everything becomes readable: charts, category views, detailed history.

Projection, next. Good management is useless if it doesn't let you anticipate. Boney shows you if you're on track, warns you when a recurring expense is coming up, helps you visualize your month or year. You can set goals by category, adjust them, track them live. You're no longer chasing the numbers they come to you.

Sharing, finally. Not just in the sense of "who owes what," but in the broad sense: building a shared vision, splitting things fairly, adapting the rules to each group. With Boney, you choose how to split an expense: equally, by shares, by exact amount. The app adapts to your reality, not the other way around.

It's this trio clarity, projection, sharing that makes Boney more than just an app. It's a space where your finances can breathe. Where you can finally align your choices, your pace, and the people you share part of your life with.

Today, hundreds of people have taken the leap

What they say (and why they stay)

Boney isn't just our story anymore. It's the story of hundreds of users who've made it part of their daily lives, each in their own way.

There are those housemates who ditched the never-updated shared spreadsheet, finally tracking monthly groceries without tension.

Those couples juggling personal accounts, transfers, and fuzzy memories of the last restaurant, who found a way to centralize everything... without infringing on each other's independence.

Parents who, for the first time, can show their teens how household expenses are split and discover it can even be fun.

Groups of friends organizing vacations, restaurants, or group gifts in a few clicks, without hassle or "who owes what again?".

And even freelancers, who use Boney to keep a clear eye on business expenses alongside their personal budget.

Every time, it's not just about numbers. It's about clarity, smoothness, trust.

They stay because it's a relief. Because it brings structure. Because it lets them breathe financially, alone or together.

And above all, because they can finally say: I know where I stand.

And you? Where do you stand with your budget?

Most of the time, we don't really decide how we manage our money. We make do. We adapt. We cobble things together. We put things off.

And one day, we realize we're not really sure what's ours, what we share, what we plan, what just happens to us.

It's not a disaster. But it's not inevitable either.

With Boney, we didn't try to oversimplify. We just wanted to clarify. To offer a space where everyone can see, understand, share without getting lost.

You don't need to change your way of living. Just take back control of what you experience.

Start small. A shared budget. A tracked expense. A set goal. And let the rest follow.

That's what Boney is here for.